Cost shouldn't dictate whether you automate. For businesses across the UK considering AI implementation, government funding can cover between 50% and 100% of transformation costs, including consultancy fees and technology spend.

At nocodecreative.io, our clients have successfully secured funding via these schemes while delivering AI and automation solutions that generate measurable impact. Founded in 2022 and based in Stirling, Scotland, we specialise in low-code platforms like n8n, Microsoft 365 & Power Platform, Azure, AWS, FlutterFlow, WeWeb, Lovable and more. From property and real estate firms transforming back-office processes with AI, to healthcare providers implementing AI-powered, personalised nutrition systems, to SMEs streamlining customer communication, we combine deep technical expertise with practical, outcome-focused problem-solving.

This guide explains which government schemes can fund your AI transformation, which apply to your situation, and how to access them before deadlines pass.

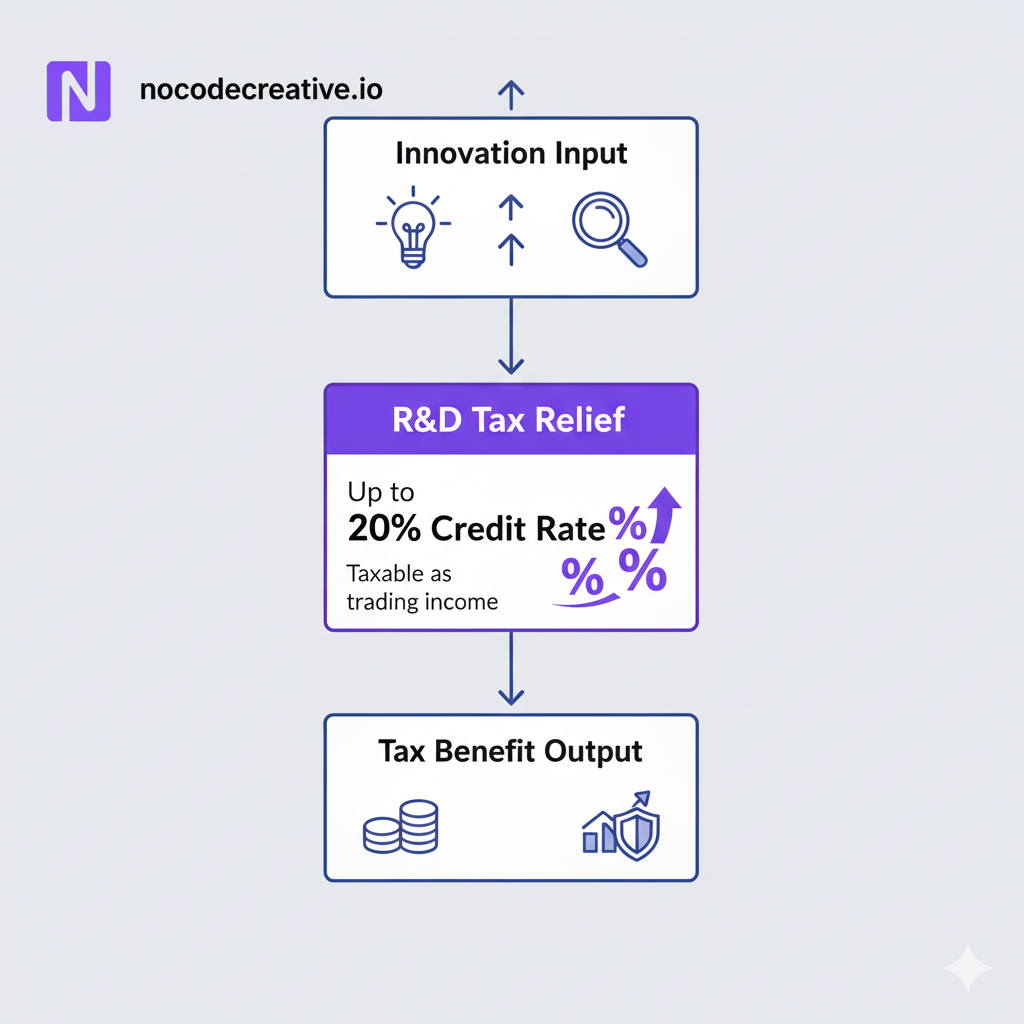

UK-Wide Funding: HMRC R&D Tax Relief

How R&D Tax Relief Works

If your AI project involves genuine innovation, you may qualify for HMRC R&D tax relief. This scheme applies across England, Scotland, Wales, and Northern Ireland. The emphasis sits squarely on innovation. Simply implementing existing tools doesn't qualify. Resolving technical uncertainties or pushing technical boundaries does.

The scheme applies to accounting periods beginning on or after 1 April 2024 through a merged approach that consolidates previous separate schemes. It offers a 20% credit on qualifying R&D expenditure for both profit-making SMEs and large companies. This credit is taxable as trading income, so your actual net benefit will depend on your corporation tax position.

Enhanced Support for R&D-Intensive SMEs

For loss-making SMEs with intensive R&D spend, there's an enhanced route. Loss-making SMEs can opt for Enhanced R&D Intensive Support (ERIS) if their R&D expenditure represents at least 30% of total expenditure.

How ERIS works:

When you spend money on qualifying R&D, it already appears as a 100% deduction in your accounts (your actual cost). Under ERIS, you can deduct an additional 86% of those costs when calculating your tax loss. This means you're deducting 186% in total - more than you actually spent - as a tax incentive to encourage R&D investment.

Once you've created this enhanced loss, you can surrender it for a cash payment worth 14.5% of the surrenderable loss. This credit is not taxable.

Example: If you spend £100,000 on qualifying R&D:

- £100,000 appears in your accounts as normal (100%)

- You add £86,000 extra deduction for tax purposes (86%)

- Total tax deduction: £186,000 (186% of your spend)

- Cash credit: Up to 14.5% of the surrenderable loss

This intensive route particularly benefits early-stage technology companies investing heavily in development before reaching profitability.

What Qualifies as R&D for AI Projects

Custom AI agent development that resolves technical uncertainties qualifies. Advanced workflow automation requiring novel solutions qualifies. Integration challenges involving complex data processing or machine learning qualify. Building intelligent applications that push technical boundaries qualifies.

The scheme covers:

- Staff costs for technical development work

- External consultancy fees (including services like ours)

- Software and cloud computing costs

- Subcontracted R&D work

The Claim Process

The claim process requires detail. You must submit claims through your Company Tax Return alongside an Additional Information Form detailing your project and costs.

Important requirements:

- First-time claimants and those who haven't claimed in three years must submit a claim notification between the start of the accounting period and six months after it ends

- Claims must be filed within two years of your accounting period end

- The Additional Information Form must be submitted before or with your CT600

For first-time SME claimants seeking upfront certainty, Advance Assurance provides confidence for your first three claims before you invest in development. This removes uncertainty about whether your project will qualify.

Scotland-Specific Funding: Direct Grant Support

For Scottish businesses, additional direct grant funding specifically targets AI adoption. These schemes take a different approach from R&D tax relief. Rather than rewarding innovation after the fact, they fund practical adoption and implementation upfront.

National AI Adoption Programme

The National AI Adoption Programme is open to any Scottish SME or social enterprise interested in AI adoption. Delivered by Scottish Enterprise, Highlands and Islands Enterprise, South of Scotland Enterprise, and The Data Lab, the programme provides:

- Grant funding for AI implementation

- Specialist consultancy support

- Training and change management

- Networking opportunities

The programme is funded until 31 March 2026. That end date matters. All project activity and spend must be completed by that date. Given the time required for scoping, approval, and delivery, early applications make sense.

AI Adoption Transformation Fund

For larger AI projects, the AI Adoption Transformation Fund offers grants between £5,000 and £25,000, covering up to 50% of eligible costs. This fund targets businesses already working with Scottish Enterprise, ideally with 10 or more employees.

Key details:

- Requires 50% match funding from your business

- Projects must be completed by 31 March 2026

- Final claims accepted until 30 April 2026

- Available to businesses in Scottish Enterprise areas (Aberdeen City and Shire, east Scotland, Tayside, west Scotland)

The fund covers external consultancy fees for AI implementation, temporary AI specialists and graduate placements, training and change management support, and technology costs associated with AI adoption.

Apply by contacting your Scottish Enterprise account manager directly, or submit an enquiry through Find Business Support for the National AI Adoption Programme.

AI Adoption Feasibility Fund

Before committing to full implementation, you might want to explore feasibility. The AI Adoption Feasibility Fund offers grants between £2,000 and £25,000 (up to 50% of costs) specifically for feasibility studies. This helps assess whether AI adoption makes commercial sense for your specific business activities before making larger investments.

Practical Applications Across Sectors

Understanding abstract funding criteria matters less than seeing how it applies to real projects. Potential projects for funding could include:

Property Management & Real Estate

- AI-powered tenant chatbots for 24/7 inquiry handling and maintenance requests

- Automated invoice processing reduces manual work by 85% (as seen with Yates Hellier & Western Lettings)

- Automated lease management systems using workflow platforms

- Predictive maintenance scheduling

- Smart property valuation tools using machine learning and market data

- Document management and contract analysis automation

One of our property management clients uses AI agents combined with n8n automation to process invoices 85% faster with 99% accuracy, freeing their team to focus on customer relationships rather than data entry.

Healthcare & Life Sciences

Healthcare providers face unique operational challenges that AI can address:

- Personalised nutrition guidance systems analysing genetic data in real-time

- Automated patient communication platforms and appointment scheduling via intelligent workflows

- Clinical data processing with analytics dashboards for faster decision-making

- Medical document processing and records management

- Treatment plan generation and monitoring systems

We're currently developing systems that bridge the gap between complex genetic information and practical, everyday nutrition advice, demonstrating how AI can make specialised knowledge accessible.

Professional Services (Accounting, Legal, Consulting)

Professional services firms benefit from automation that handles routine tasks while maintaining accuracy:

- Automated document review and contract analysis

- Client communication workflows and meeting scheduling

- Invoice processing and financial data extraction

- Meeting transcription and analysis with action item tracking

- Knowledge base management and information retrieval systems

- Time tracking and resource allocation automation

Our meeting analysis solution uses GPT-4.1 to automatically transcribe Teams meetings, extract action items, and integrate with Outlook and knowledge management systems.

Manufacturing & Supply Chain

Manufacturing businesses face operational complexity that AI can streamline:

- Inventory management and demand forecasting

- Quality control automation with image recognition

- Supply chain optimisation and supplier communication

- Production scheduling and resource allocation

- Equipment maintenance prediction and scheduling

- Real-time production monitoring dashboards

Events & Hospitality

Event management and hospitality businesses can automate guest experiences and operations:

- Digital meal management and dietary requirement tracking (like our ScranQR platform for APL Events)

- Automated booking and customer communication systems

- Event planning and logistics coordination

- Feedback collection and sentiment analysis

- Inventory and supplier management

- Staff scheduling and resource allocation

ScranQR, our custom SaaS platform for festival meal management, digitised workflows and reduced waste while providing actionable insights for event operations.

Education & Training

Educational institutions and training providers can enhance learning delivery:

- AI-powered voice assistants for language learning (like our work with Ybmblex Education)

- Automated student communication and progress tracking

- Course content generation and personalisation

- Assessment automation and feedback systems

- Administrative workflow automation

- Learning analytics and reporting dashboards

Retail & E-commerce

Retail businesses can enhance customer experience and operational efficiency:

- AI-powered customer service chatbots

- Inventory forecasting and stock management

- Dynamic pricing and promotion automation

- Customer behaviour analysis and personalisation

- Order processing and fulfilment automation

- Multi-channel integration and synchronisation

Financial Services

Financial institutions require robust automation with compliance built in:

- Document processing and KYC verification

- Transaction monitoring and fraud detection

- Customer onboarding automation

- Financial reporting and analytics

- Compliance monitoring and audit trail generation

- Portfolio analysis and recommendation systems

Combining Multiple Funding Sources

Scottish AI grants and HMRC R&D tax relief work together rather than competing. However, combining them requires careful planning and documentation.

Scottish grants fund the adoption and implementation phase, covering external consultancy, training, and integration costs. R&D tax relief applies to genuine innovation and technical problem-solving within the project.

Example in practice: A property management firm could use Scottish AI funding to cover consultancy fees for implementing an AI tenant management system, while simultaneously claiming R&D relief for custom machine learning components predicting maintenance issues. The adoption funding covers practical implementation. The R&D relief rewards innovation.

You must clearly document any subsidy or contracted-out arrangements to comply with both schemes' rules, particularly under the merged R&D scheme that tightened requirements around subsidised expenditure.

Additional Schemes of Interest

Beyond AI-specific funding, several programmes support digital transformation and innovation across the UK.

Scottish Enterprise R&D Grants (Scotland Only)

For larger-scale innovation projects in Scotland, Scottish Enterprise R&D Grants offer substantial support with a minimum grant of £150,000. These grants cover:

- 35-50% of eligible project costs for SMEs

- 25-40% of eligible project costs for large companies

While requiring higher project scale than AI adoption programmes, these grants prove valuable for businesses developing major new products or processes incorporating AI as part of broader innovation. Projects must align with Scottish Enterprise's priority areas: creating an internationally competitive energy transition industry, scaling innovation into high-growth industries, or driving capital investment to improve productivity.

Scottish Enterprise Business Grants (Scotland Only)

Scottish Enterprise also offers business grants for implementing new products and processes, providing funding of up to £100,000 to employ short-term staff or engage specialist consultants. These support initiatives enhancing productivity, efficiency, and sustainability—all common outcomes of AI implementation.

Innovate UK Funding (UK-Wide)

At UK level, Innovate UK manages programmes relevant to AI projects, though these are competitive and sector-specific. The Smart Grants programme has been paused with no rounds in financial year 2025/26. Planning for future funding programmes will be considered as part of Innovate UK's long-term strategy.

Businesses should instead explore:

- Themed competitions targeting specific innovation challenges and sectors

- Sector-specific programmes aligned with government priorities (net zero, healthcare, advanced manufacturing)

- Collaborative R&D programmes requiring partnerships between businesses and research organisations

Check the Innovation Funding Service regularly for new competitions matching your innovation area.

Critical Deadlines to Note

For Scottish AI Funding

All project activity and costs must be completed and paid by 31 March 2026, with final claims for the AI Adoption Transformation Fund due by 30 April 2026. Given limited funding pools and the need to scope, approve, and deliver projects within this window, waiting until early 2026 risks missing out entirely.

For UK R&D Tax Relief

Claims must be filed within two years of your accounting period end. The Additional Information Form must be submitted before or with your CT600. First-time SME claimants should consider applying for Advance Assurance early in the project lifecycle to gain certainty before investing.

At nocodecreative.io, we deliver technical solutions and prepare the documentation to support funding applications.

Our support includes:

- Technical documentation preparation, including project scope, technical narrative, and cost breakdowns required for claims

- Implementation structured to maximise eligible costs while meeting scheme requirements

- Ongoing project documentation to support HMRC and Scottish Enterprise audits

We've supported clients who successfully secured HMRC R&D tax relief approval for custom AI development work. Our projects involve building intelligent automation solutions that resolve genuine technical uncertainties."

Ready to Start Your AI Transformation?

Government funding can remove the financial barriers to AI implementation. Whether you're exploring workflow automation, building custom AI systems, or developing intelligent applications, these schemes can cover a substantial portion of your costs.

For businesses across the UK, R&D tax relief provides retrospective support for innovative projects. For Scottish businesses, direct grants offer upfront funding for practical adoption. The combination can make ambitious projects financially viable.

Your next steps:

- Book a consultation – We'll assess your project against funding criteria and outline which schemes might apply to your situation

- Review eligibility – Explore the official guidance linked in the resources table below

- Act quickly – Scottish funding deadlines create urgency; early applications increase success rates

The deadline for Scottish AI funding approaches. Projects need scoping, approval, and delivery time. Early action matters.

Contact us at hello@sales.nocodecreative.io or book an appointment here https://cal.com/nocodecreative/new-enquiry to discuss your AI transformation and funding options.

Official Resources

| Title | Description | Link | Scheme Type |

|---|---|---|---|

| HMRC R&D Relief Overview | Eligibility, definition, and how R&D tax relief works | gov.uk/r&d-relief | R&D Tax Relief (UK-Wide) |

| Additional Information Form | Mandatory form required with all R&D claims | gov.uk/aif | R&D Tax Relief (UK-Wide) |

| Advance Assurance (SMEs) | Pre-clearance for first-time SME claimants | gov.uk/advance-assurance | R&D Tax Relief (UK-Wide) |

| Merged R&D Scheme Guidance | Official guidance on merged scheme (from 1 April 2024) | gov.uk/merged-scheme | R&D Tax Relief (UK-Wide) |

| National AI Adoption Programme | Scotland’s main AI adoption support programme | findbusinesssupport.gov.scot | Scottish AI Funding |

| AI Adoption Transformation Fund | £5k–£25k grants for Scottish businesses | findbusinesssupport.gov.scot | Scottish AI Funding |

| AI Adoption Feasibility Fund | £2k–£25k grants for AI feasibility studies | findbusinesssupport.gov.scot | Scottish AI Funding |

| Scottish Enterprise R&D Grants | Large-scale R&D grants (minimum £150k) | scottish-enterprise.com | Innovation Grants (Scotland) |

| Scottish Enterprise Business Grants | Various grants for implementing new products/processes | scottish-enterprise.com | Innovation Grants (Scotland) |

| Innovate UK Funding Search | Current innovation competitions and themed grants | apply-for-innovation-funding.service.gov.uk | UK Innovation (UK-Wide) |